Property taxes for Chicago Public Schools will rise on bills that come out next week, but the rates paid by city homeowners still will be lower than in all but a few suburbs, new data obtained by the Tribune show.

CPS officials have estimated that the owner of a $250,000 home will see a property tax increase of $28, but tax experts caution that too many variables are involved to say precisely what to expect. Those variables include the home's market value, how long a home has been owned by the same person, the home's neighborhood and the owner's age.

Cook County Clerk David Orr will release tax rates for school districts, villages, park districts and the like on Tuesday. The rates will be used to calculate the second installment of tax bills that Treasurer Maria Pappas will mail out July 1. To avoid a penalty, those bills must be paid by Aug. 1.

-

- ANTONIO PEREZ, CHICAGO TRIBUNE

Cook County Clerk David Orr will release tax rates for school districts, villages, park districts and the like on Tuesday.

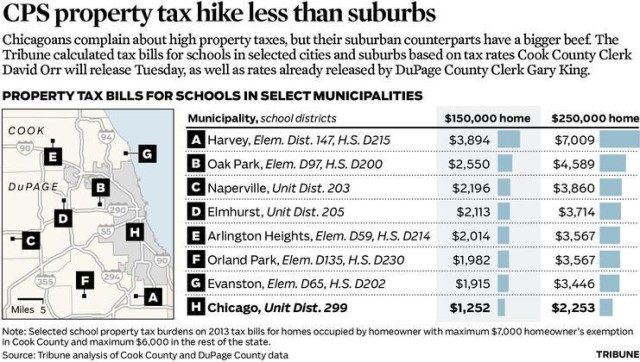

Chicagoans have long bemoaned high property taxes, but the new rates illustrate that their pain pales compared with their suburban counterparts.

In Chicago, the average school property tax tab, including money collected by CPS and the School Finance Authority, is about $1,252 for an owner-occupied home that would sell for about $150,000, according to the data.

By comparison, the public school tax bill in west suburban Oak Park on a home worth about the same amount of money — if one could be found — would be about twice as much, the data showed. Homeowners in south suburban Harvey, which has some of the highest property tax rates in the region, will pay three times as much for public education.

It's a property tax fact that's been true for years: The overall tax rate for Chicago homeowners is lower than in any Cook suburb. That trend continues this year for both schools and all taxing districts combined. Chicago homeowners also pay less in property taxes than those in all but a few collar county suburbs — in large part because there's so much commercial and industrial property in Cook that is assessed at a much higher rate and bears the bulk of the tax burden.

That's not such good news for nonresidential property in Cook. They generally are hit with higher rates — in some suburbs four or five times higher — than their collar-county counterparts. In Chicago, commercial rates are lower than in nearby suburbs but still among the highest paid in the collar counties. The long-standing practice has been viewed as a way to keep happy the homeowners who decide elections.

Typically, more than half of the money collected through property taxes goes to pay for schools in the city and suburbs. The amount levied by CPS has been at issue in recent weeks, as the Board of Education looks for ways to plug a cash shortfall for next year that school officials peg at $1 billion.

Mayor Rahm Emanuel, who controls the city's public schools, recently declined to rule out trying to increase school property taxes beyond the rate of inflation, which would require permission from voters through a referendum or a lifting of the tax cap by the state General Assembly. Either way, the mayor would have to marshal all arguments at his disposal.

CPS spokeswoman Becky Carroll said district officials have not discussed a referendum or legislative change allowing a higher tax increase because they've been focused on trying to get a measure to address a looming pension funding cost spike.

The new tax data from Orr's office came after a Civic Federation study released this year concluded that Chicago homeowners in recent years paid lower property tax bills than all their counterparts in the rest of Cook, as well as most of the collar counties.

Some isolated communities, like Oak Brook with its large shopping mall and corporate headquarters, had lower overall taxes when similarly priced homes were compared. Some outlying communities with nuclear plants share similar advantages.

Laurence Msall, president of the budget watchdog group, said one also must take into account that sales taxes, fines and fees tend to be much higher in the city than in the suburbs. Still, Msall argued, CPS shouldn't use the lower relative property tax burden on homeowners to justify a larger tax hike. Instead, the district should come out with a long-term plan that shows it is getting a grip on its financial issues, he said.

"Will the increased taxes improve the quality, or the amount of services that residents receive, or at least address long-term financial needs for the governments rather than just raising taxes to address an immediate short-term problem?" Msall asked.

Twitter @ReporterHal